Handling Failure Payouts.

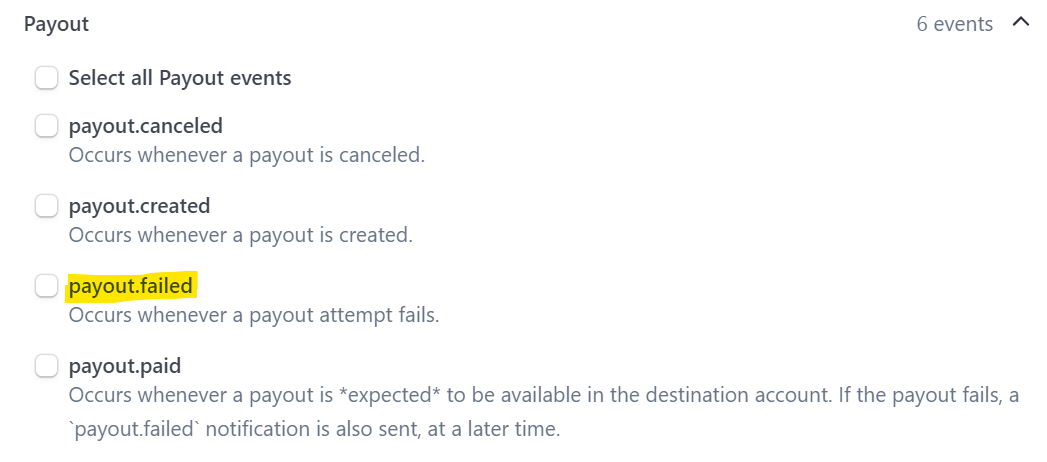

So you will receive a web hook payout.failed with meta data including reason of failure and codes.

Here's a list of the failure codes and their meanings:

account_closed: The bank account associated with the payout has been closed.account_frozen: The bank account associated with the payout has been frozen.bank_account_restricted: The bank account has restrictions on the type or number of payouts allowed, often indicating that it is a savings or non-checking account.bank_ownership_changed: The destination bank account is no longer valid because its branch has changed ownership.could_not_process: The bank was unable to process the payout.debit_not_authorized: Debit transactions are not approved on the bank account. Stripe requires bank accounts to be set up for both credit and debit payouts.declined: The bank has declined the transfer. It is recommended to contact the bank for further clarification before retrying.insufficient_funds: The Stripe account has insufficient funds to cover the payout.invalid_account_number: The routing number appears correct, but the account number is invalid.incorrect_account_holder_name: The bank has notified Stripe that the bank account holder name on file is incorrect.incorrect_account_holder_address: The bank has notified Stripe that the bank account holder address on file is incorrect.incorrect_account_holder_tax_id: The bank has notified Stripe that the bank account holder tax ID on file is incorrect.invalid_currency: The bank was unable to process the payout due to currency incompatibility. This might occur when the bank account cannot accept payments in the specified currency.no_account: The bank account details on file are likely incorrect, and no bank account could be located with those details.unsupported_card: The bank no longer supports payouts to the specified card.

And the structure

json

{

"id": "po_1NTSazHTGgsC5BiiIn54l5Nb",

"object": "payout",

"amount": 1100,

"arrival_date": 1689206400,

"automatic": true,

"balance_transaction": "txn_3LZZ3PHTGgsC5Bii0HVQ6XOs",

"created": 1689266545,

"currency": "usd",

"description": "STRIPE PAYOUT",

"destination": "ba_1NTSazHTGgsC5BiiS52u0ep2",

"failure_balance_transaction": null,

"failure_code": null,

"failure_message": null,

"livemode": false,

"metadata": {},

"method": "standard",

"original_payout": null,

"reconciliation_status": "not_applicable",

"reversed_by": null,

"source_type": "card",

"statement_descriptor": null,

"status": "in_transit",

"type": "bank_account"

}

So you will find the payout from your transactions table follow these steps

- Notify the User:

- Inform the user promptly about the failed payout through email or in-app notifications.

- Clearly explain the reason for the failure, referencing the specific failure code or providing a user-friendly explanation of the issue.

- Provide Instructions:

- Instruct the user to review and correct the inputs or details associated with the failed payout.

- Clearly communicate what needs to be corrected, such as bank account information, account holder name, or any other relevant details.

- Offer guidance on how they can update the information within your app.

- Update User Interface:

- Modify the user interface in your app to allow users to easily access and update the necessary information.

- Provide clear instructions and intuitive design elements to guide users through the correction process.

- Consider implementing validation checks to ensure that corrected inputs meet the required format and criteria.

- Assistance and Support:

- Offer support channels, such as customer service or help desk, where users can reach out for assistance.

- Provide prompt responses to user inquiries and be prepared to address any questions or concerns they may have regarding the failed payout.

- Retrying the Payout:

- Once the user has corrected the necessary inputs, you can automatically schedule a retry of the payout at the next payout interval.

- Initiate the payout using the updated and verified information.

- Monitoring and Communication:

- Continuously monitor the status of retried payouts and keep the user informed of any updates or changes in the payout status.

- Consider sending email notifications or in-app messages to inform the user about the retry attempt and subsequent status changes.